- The Publisher Newsletter

- Posts

- How Charlie Kerr built a $1.8bn data powerhouse

How Charlie Kerr built a $1.8bn data powerhouse

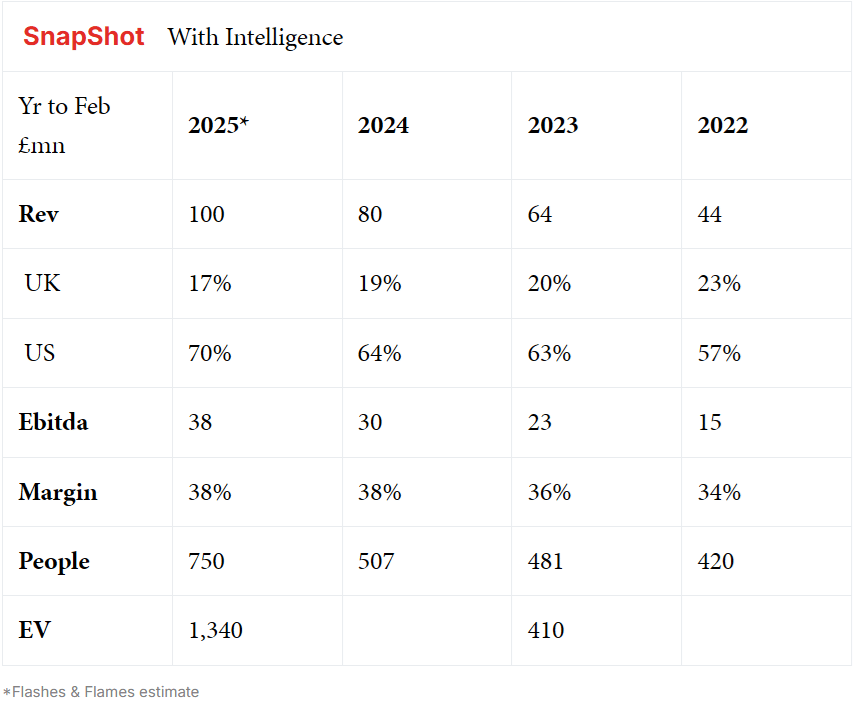

S&P Global has agreed to acquire the UK-based, financial data provider With Intelligence for $1.8bn (£1.3bn), some 13x revenue and 30x EBITDA.

Welcome to The Publisher Newsletter, by Media Voices: your weekly newsletter profiling the people and products powering publishing.

Reproduced from Flashes & Flames: The Global Media Business Weekly.

How Charlie Kerr built a $1.8bn data powerhouse

S&P Global has agreed to acquire the UK-based, financial data provider With Intelligence for $1.8bn (£1.3bn), some 13x revenue and 30x EBITDA. It provides analytics, data and events on alternative assets such as hedge funds, private equity, real estate and private credit.

These “alt” investment classes are believed to account for some 30% of the asset management industry but perhaps 60% of the fees. That and the growth prospects explain why the price of With Intelligence is 3x that paid by majority owner Motive private equity just two years ago.

Motive’s £410mn price in 2023 had itself been 16x EBITDA and 3x the £135mn enterprise value of 2020 when Intermediate Capital Group (ICG) had previously taken control. ICG had retained a 10% shareholding (and also mezzanine debt in the company) alongside Motive’s 77% and founder-CEO Charlie Kerr (13%).

It’s a spectacular 2-3 year increase in value. But timing is everything and the 2023 valuation, arguably, reflected a premature decision to sell when the price might have increased by 50% a year later. On the other hand, this week’s price might itself have been expected a full 12 months from now – but was advanced by the hungry ambition of the $160bn S&P Global.

Kerr: transformed a publisher into a data provider

The deal, which is expected to complete in 4-6 weeks (subject to US regulatory approval), will give S&P – best known for its stockmarket indices, commodity prices and credit ratings – proprietary data in the forecast $40trillion alternative investment market, from 34,000 private equity groups, 19,000 real estate investors and 17,000 hedge funds, with a database of 350k deals. S&P had recently announced the launch of its index tracking the top-50 private equity funds.

The ‘alt’ market is now a fierce battle.

The acquisition of With Intelligence comes 18 months after S&P had been outbid by BlackRock in the $3.2bn (£2.6bn) sale of the 22-year-old private data leader Preqin. That deal was said to accelerate BlackRock’s push to become a major player in alternative investment, following its $12.5bn acquisition of Global Infrastructure Partners. In fact, it galvanised both With Intelligence’s data acquisition strategy and also S & P’s own determination not to be left behind.

The Preqin price excited everyone, including Charlie Kerr.

It’s just a year since With Intelligence acquired (from Bain) the SPS pe analytics provider for some £30mn (3x revenue). It was significant because it was the third deal in the 18 months since acquisition by Motive. But it also propelled the 27-year-old company into the private equity deals space for the first time – in line with its bigger rivals, Preqin and Pitchbook. It had previously stayed away from covering pe deals, preferring to focus on providing fund-raising data and insight for hedge and private market fund managers.

However, it had become clear that With Intelligence was potentially losing out on business from pe firms which would prefer to buy their fund-raising and deals data from a single source. Moreover, the company believed the deals data would make it more attractive to allocators increasingly using its platform to inform their investment decisions. Focused primarily on private markets, SPS brought transaction-level data on 100,000+ tracked deals. Together with Bain’s unique industry taxonomy (licensed as part of the deal) it helps subscribers to unify the fragmented deal sourcing environment and gives greater transparency of the deals most relevant to their investment strategy.

The SPS deal proved not to be With Intelligence’s last because it acquired Realfin and The Deal, as the CEO continued his single-minded drive to create a £1bn enterprise value business. And, now, it has not only exceeded that ambition but done so more quickly than the CEO might once have expected. It’s a successful strategy built not on large strategic acquisitions or transformative moves but on Kerr’s canny strategy of buying small bolt-on businesses. More than a dozen acquisitions since 2020 have collectively adding £40mn to the revenue which will have been some £100mn in the year to February 2025.

The transformation of With Intelligence from traditional B2B publisher to financial data provider had been remarkable, even before this latest acquisition. The company, like its founder, is a fascinating (and, perhaps, unlikely) case study.

UK newspapers periodically comment on the fact that Charlie Kerr left school at 16. In creating the impression of a scarcely-educated rebel, they manage to omit the detail that he is the son and heir of a hereditary British Lord (yes) and attended a swanky boarding school. But he really did build his business career the hard way, selling classified ads for regional newspapers and low-value magazines for a decade before going it alone.

Kerr’s non-standard CV feeds through into a highly popular but unconventional leadership style, marked by wandering around the office scruffy and shoeless in bright-coloured socks. He’s great with people but not on detail, and hates writing anything down.

He and schoolfriend Sebastian Timpson had bootstrapped their startup Pageant Media with maxed-out credit cards. Their first B2B magazines were Offshore World (failed) and E-Gaming Review. At the start, it was a classic 20th century B2B publisher of free magazines funded by advertising, but Kerr saw the light. The 2008 banking crisis gave him experienced jobless recruits as he shifted his telephone sales teams over from selling low-value advertising to high-value subscriptions. Back in 2012, some 40% of the company’s revenue came from advertising. But now it’s all about pre-paid digital subscriptions and membership events.

Kerr’s next ‘light bulb’ moment had been in 2019 when he realised the business could be worth many times as much if it became a high-value, paid-for data provider. That’s why the company is unrecognisable today, having killed off most of its old publishing and events brands, all but abandoned advertising, and built an enterprise subscription, data and insights platform.

It became With Intelligence in 2021.

The company now being acquired by S&P is ‘data first’, with a relentless focus on relevance, accuracy and recency, in an industry which values these criteria more highly than scoops and exclusives – and, crucially, can afford to pay for what it wants (average customer yield is now around £25k and growing strongly).

With key brands including EurekaHedge, FolioMetrics, The Deal, Pension Bridge, Hedge Fund Alert, Falk Marques, Realfin, and Pension Funds Online, it delivers “a unique blend of data and intelligence”. But Kerr says the secret sauce may be ‘investors’ intentions and preferences’: “We’ve created highly-valued information and events membership packages for allocators. In return, they’re happy to share with us regular updates on where they’re planning to allocate investments and why”. It claims some 3,000 institutional clients, including the world’s 100 largest asset managers.

What was once a largely domestic B2B publisher has been transformed into a data business whose members themselves not only supply much of the information for its datasets but also pay anything up to hundreds of thousands of dollars for subscriptions to access it. And two-thirds of the revenue now comes from North America.

One little secret glossed over by the PR is that the With Intelligence transformation has been achieved in not much more than two years. That in itself should inspire B2B companies everywhere.

Charlie Kerr’s estimated £200mn payday (not to mention the huge gains of his pe partners) proves what can be achieved at a time when data subscriptions have never been more highly prized. Just as the onrush of AI tools is shaking the confidence of media and information companies, what could be more sustainable than high-value data subscriptions, woven together by personal relationships and data-driven live events in a fast-growing market?

For all the sensible media industry talk about revenue diversification, there’s no substitute for focus and determination.